Multi-State Tax Consulting

In this day and age, nearly every company conducts business across state lines. Are you aware of all the additional taxes and fees you may be liable for?

We assist companies with state sales tax and income tax matters. As companies expand their operations and send salespeople across the country, or sell to consumers in other states via the internet, they create into nexus (or taxable presence) and have to think about filing in other states. That’s where Miles Consulting Group comes in.

We help companies answer questions on multi-state tax compliance:

- Where do you have nexus creating activities?

- What are the rules? What are next steps?

- When was nexus created? When should you begin filing?

- How much retroactive exposure has been created? Can we help you reduce it?

As state tax rules change, we help our clients address these questions by bridging the gap between your business and complex state tax laws.

We are often asked these three questions:

- Why Is A Nexus Review Important?

- Which Activities Cause State Tax Issues?

- Are We Out of Compliance or Being Audited?

Why Is A Nexus Review Important?

A nexus study and taxability review determine where a company might have state tax exposure and the extent of that exposure. We work with our clients to identify their activities in various states and analyze the types of transactions engaged in within those jurisdictions.

Determining exposure before a proposed acquisition is good business. We also assist in determining possible exposure before a state comes to audit. And finally, we bridge the gap with respect to financial statement disclosure.

As part of each project, we work with clients to answer the following types of questions:

- What is nexus?

- Do we have physical presence nexus?

- Do we have economic nexus?

- Is my product or service taxable?

- Are there any available exemptions (e,g, food or medical exemptions, sales to qualified non-profit entities)?

- Must I start collecting and remitting sales and use tax?

- I’ve collected tax from a given state and have not remitted it-what now?

Once we determine possible exposure, we assist clients in receiving maximum benefit from available amnesty programs, contract for voluntary disclosure agreements, work with their customers to determine if they have self-assessed taxes (and can therefore reduce exposure for our client) or simply document their exposure.

Economic Nexus

In the United States, the sales tax landscape drastically changed due to the U.S. Supreme Court ruling in South Dakota v. Wayfair, Inc. In June 2018, the High Court made a landmark decision that it is constitutional for the State of South Dakota to enact an economic nexus law. This established precedent and paved the way for states to establish additional ways companies may establish nexus in their jurisdiction.

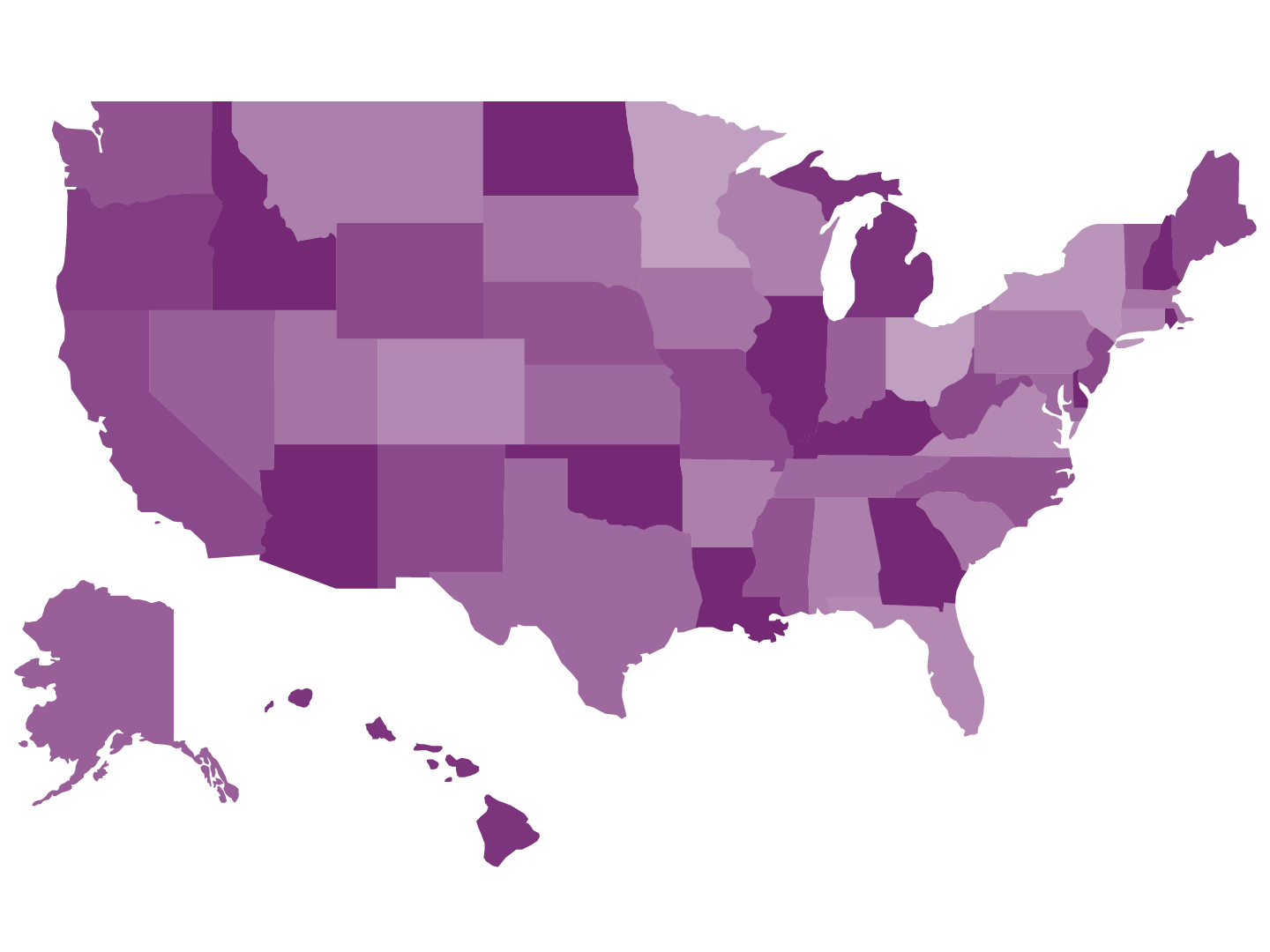

Now all states which impose a state level sales tax (as well as some local jurisdictions) have enacted economic nexus laws. As a result, companies must now consider both their physical footprint (employees offices, inventory) and the level of sales activity they have in a given state. Once nexus has been established companies need to consider registering for sales tax, collecting and remitting tax, and then filing tax returns. We call that “compliance.”

What Is Economic Nexus?

In states which have enacted statutes, economic nexus is based on the amount of sales by dollar volume or a number of transactions threshold. While states differ, generally, if either is met, economic nexus is triggered. Some states require both criteria for economic nexus to be valid, while others require just one of the two. In the South Dakota case, for instance, the thresholds are $100,000 in sales or 200 transactions. Some of the largest states (CA, NY and TX) have raised their thresholds to $500,000—making it a little easier on small sellers.

Additionally, some states base their economic threshold measurement on taxable sales, while other states base this threshold on gross sales.

How Does This Impact Your Business’ State Tax Compliance?

If your company is doing business in a state and you didn’t have physical presence in a state before the Wayfair ruling, chances are you now have nexus via economic presence.

The arguments presented in the ultimate Wayfair ruling were initially targeted at remote sellers engaging in internet sales as states felt they were missing out on sales tax from these transactions. However, the way the economic nexus laws are written are quite broad so the net has been cast much wider. As such, many “traditional” companies that use traditional salesforces and ship goods and services across state lines (even if not ordered online) are also impacted. This includes technology industries selling software and software-as-a-service (SaaS).

Which Activities Cause State Tax Nexus Issues?

As states are becoming more aggressive with respect to tax collection, they are also broadening the activities that cause nexus, or taxable presence, for companies. This is important because once a company has nexus, they can be subject to sales tax collection, income tax reporting and other taxes as well.

Some activities that may cause nexus (and therefore state tax reporting issues) include:

- The hiring of an employee

- Contracting with an independent contractor

Maintaining inventory in third party warehouses - Owning property or renting office space

- Exceeding a certain threshold of sales or transactions in a given state (see the Wayfair case discussion)

- Using fulfillment services like Fulfillment By Amazon (FBA) or similar services which place inventory in third party warehouses in different states

Once a company begins doing business in a state, we assist with procedures for filing necessary sales tax and income tax returns. We also help with apportionment reviews and general compliance.

On the income tax side, one hot topic is properly sourcing revenue for service-based companies. Many states have embraced a concept referred to as “market-based sourcing” for service revenues. That generally means that the revenue will be recognized in the state in which the value of the service was received. What that means can vary by state.

Are We Out Of Compliance Or Being Audited?

When companies find themselves out of compliance or at the mercy of an audit notice, we assist.

If out of compliance, we work with client personnel to determine the extent of exposure and develop a plan of action to get into compliance.

If a client is being audited, we assist with early, middle or late-stage audits, protests, etc. We work directly with auditors on our client’s behalf to achieve the best possible result. Each audit situation is unique; however we work with each client to tailor a solution. Our team has years of prior experience working as state tax auditors, so we bring an especially helpful perspective to our clients.