Updated July 21, 2020

Are you curious if you need to be paying taxes on or charging your customers sales tax on your sales of these revenue streams: Software-as-a-Service (SaaS), cloud computing and electronically downloaded software? The answer is, maybe. Because these three areas are defined differently by each state, it’s important to understand how each state’s tax codes approaches them.

Being aware of the tax ramifications in any state your company has established nexus is incredibly important, especially considering last summer’s Wayfair decision. While the U.S. Supreme Court’s decision may seem like it was only directed at online sellers, the truth is that multi-state sellers (such as those generating revenue from SaaS and software) are also affected. Because of the ruling, it will be even easier to establish nexus in more states across the country; companies need to know which taxes they’re responsible for in regards to SaaS, cloud computing and electronically downloaded software.

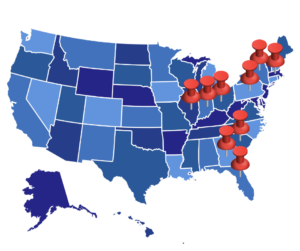

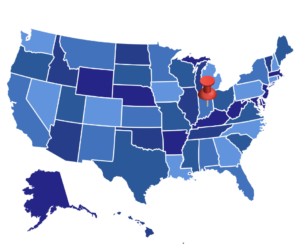

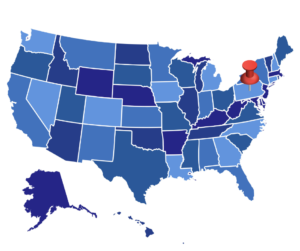

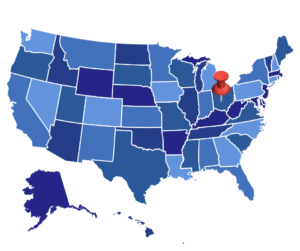

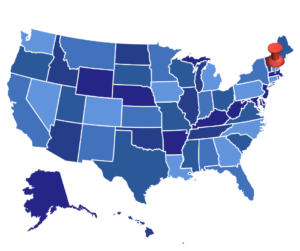

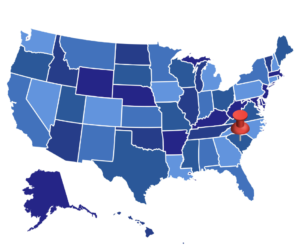

Here’s a guide to the taxability of SaaS in these nine key eastern states:

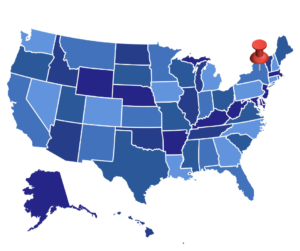

Find out about the taxability of SaaS in nine key western states in this blog post.

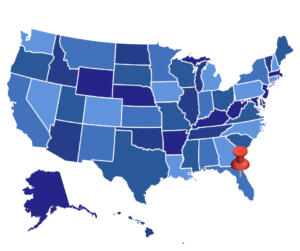

1. Taxability of SaaS in Florida

Economic Nexus Provisions: Pending

The state legislature has floated a bill for economic nexus, but it did not pass, leaving Florida as one of a handful of states without economic nexus legislation.

SaaS and Cloud Computing Tax Rules: Nontaxable

Florida has no statutes or regulations regarding the sales or use taxation of cloud computing or SaaS. The state’s Department of Revenue also determined that membership fees to access cloud computing and on-demand software are not taxable as there is no transfer of tangible personal property.

*Electronically Downloaded Software Treatment: Nontaxable

Sales of canned software, electronically downloaded by the customer are not subject to tax in Florida. These sales are not subject to tax because no transfer of tangible personal property occurs.

In addition, licenses for the use of software accessed electronically are not considered sales of tangible personal property, and therefore are not subject to state sales tax, as long as no transfer of tangible personal property occurs as a part of the transaction.

*For the purposes of this article, we are addressing the taxability of pre-written or canned software (not custom software) that is delivered electronically. Custom software is exempt in most states, regardless of the method of delivery.

*SaaS and Cloud Computing vs. Electronically Downloaded Software

Florida doesn’t tax SaaS, cloud computing or electronically downloaded software because the state doesn’t define any of them as tangible personal property.

*For purposes of this blog article, we address the taxability of pre-written or canned software (vs. custom software), which is delivered electronically. Custom software is exempt from tax in most states, regardless of the method of delivery.

2. Taxability of SaaS in Georgia

Economic Nexus Provisions: Yes

As of January 1, 2019, companies with either $250,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax. As of January 1, 2020, the threshold will be reduced to $100,000.

SaaS and Cloud Computing Tax Rules: Nontaxable

Georgia does not impose sales and use tax on SaaS, cloud-based services or hosting services. Prewritten computer software, delivered either electronically or through “load and leave” is also not subject to tax in the state, nor are computer related services, including information and data processing services.

Electronically Downloaded Software Treatment: Nontaxable

Computer software delivered electronically is not a sale of tangible personal property and therefore is not subject to sales and use tax.

Georgia is very clear that the method of delivery needs to be indicated on the dealer’s invoice, purchase contract or other documentation, or the state will assume the transaction was made through a tangible medium.

SaaS and Cloud Computing vs. Electronically Downloaded Software

This state doesn’t tax SaaS, cloud computing or electronically downloaded software either as they aren’t defined as tangible personal property.

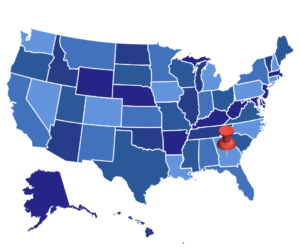

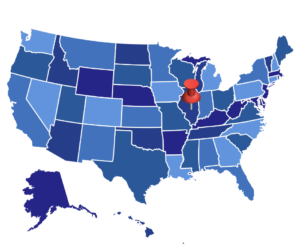

3. Taxability of SaaS in Illinois

Economic Nexus Provisions: Yes

As of October 1, 2018, companies with either $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax, as long as they meet the threshold requirements in the preceding 12-month period (analyzed every calendar quarter).

SaaS and Cloud Computing Tax Rules: Nontaxable

Illinois does not impose tax on SaaS delivered via a cloud-based system, provided the transaction does not include a transfer of tangible personal property.

This means that if the software is provided via cloud-based delivery, and the software is never actually downloaded onto a customer’s computer in Illinois, the provider is acting as a serviceman rather than a retailer and the services are not subject to any of these state taxes:

- Retailers’ Occupation Tax

- Use Tax

- Service Occupation Tax

- Service Use Tax

However, if an API, applet, desktop agent or remote access agent is provided to the subscriber to enable access to the provider’s network and services, the subscriber is then considered to have received computer software from the provider. This makes the transaction subject to tax, even if there is not a separate charge to the subscriber for the computer software, unless the transaction qualifies as a non-taxable license of computer software.

If the provider is not otherwise required to be registered for purposes of the Retailers’ Occupation Tax, and qualifies as a de minimis serviceman, the provider could elect to pay Use Tax on its cost price of the computer software.

Another item of note is that the city of Chicago does tax the SaaS revenue stream in the form of a Lease Tax. For more information about this “unique” approach in Chicago, please contact us.

Electronically Downloaded Software Treatment: Taxable

The sale at retail or transfer of canned software intended for general or repeated use is taxable when it is delivered electronically.

SaaS and Cloud Computing vs. Electronically Downloaded Software

Because Illinois doesn’t consider SaaS or cloud computing tangible property, neither is subject to tax. However, electronically downloaded software is considered tangible property, which is why it’s subject to the state’s taxes.

4. Taxability of SaaS in Indiana

Economic Nexus Provisions: Yes

As of October 1, 2018, companies with either $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax.

SaaS and Cloud Computing Tax Rules: Depends (But Generally Nontaxable)

The taxability of “cloud-based” software or SaaS depends on the facts and circumstances of each transaction, including the amount of control or possession granted to the purchaser.

Charges for access to prewritten software located on computer servers outside of the customer’s workplace are taxable if the customer gains constructive possession and the right to use, control or direct the software’s use.

However, these charges are not subject to tax if the customer is not transferred the software, does not have an ownership interest in the software, and does not control or possess the software or the server (this is generally the case with typical SaaS contracts).

Along these lines, a subscription to an online database that allows the customer to download reports, documents and other information is not subject to tax if the customer does not gain control of the underlying software of the database.

Where a customer can show that charges are actually for professional or personal services and access to software is merely incidental to the services, the transaction will not be treated as the taxable sale of prewritten software accessed via cloud computing.

Electronically Downloaded Software Treatment: Taxable

Prewritten computer software is subject to gross retail tax, regardless of the method by which the software is delivered (tangible medium, load and leave, or electronically).

Use tax is due on software and software licenses for which a taxpayer accepts delivery in Indiana, and for which it provides no evidence that the software or licenses were “used” in another state.

SaaS and Cloud Computing vs. Electronically Downloaded Software

When it comes to cloud computing and SaaS, Indiana is a bit more confusing as it depends on how much control or possession the user has. Access to data doesn’t necessarily make the services taxable, however control of the database does. Electronically downloaded software, on the other hand, is always subject to Indiana’s taxes.

5. Taxability of SaaS in Massachusetts

Economic Nexus Provisions: Yes (cookie nexus, which means nexus is created when a seller places software or web cookies on in-state computers and devices to enhance or facilitate sales)

As of October 1, 2019, companies with both $100,000 in sales establish economic nexus and are required to collect and remit sales tax. Note that this economic nexus legislation is different from many other states. Additional analysis is often required.

SaaS and Cloud Computing Tax Rules: Taxable

Both SaaS and cloud computing are generally subject to sales and use tax in Massachusetts.

The sale, license, lease or other transfer of a right to use software on a server hosted by a business or a third-party is generally taxable; Massachusetts has previously referenced the access of software from a hosted server as SaaS.

A company’s cloud computing sales that use either of the following do not involve taxable sales of prewritten software, and thus are not taxable when sold to customers in the state:

- A customer’s own software (not purchased from the company)

- Open-source (free) software available on the internet

However, a company’s cloud computing sales that include software licensed by the company are taxable when sold to customers in Massachusetts, whether or not there is a separately stated charge for the software and whether or not there is a sub-license of the software to the customer, because the object of the transaction is acquiring the right to use the software.

Electronically Downloaded Software Treatment: Taxable

Sales of prewritten computer software, regardless of the method of delivery, are subject to the Massachusetts sales tax.

SaaS and Cloud Computing vs. Electronically Downloaded Software

SaaS, cloud computing and electronically downloaded software are all taxable in the state because the object of the transaction is acquiring the right to use the software.

6. Taxability of SaaS in New York

Economic Nexus Provisions: Yes

As of June 21, 2018, companies with both $500,000 in sales and 100 separate transactions establish economic nexus. They are then required to collect and remit sales tax, as long as they meet the threshold requirements in the immediately preceding four sales tax quarters. Read more details in our blog post about New York’s economic nexus provisions.

SaaS and Cloud Computing Tax Rules: Taxable

Selling a New Yorker a license to remotely access prewritten software is subject to tax and the sale is sourced to the jurisdiction in which the purchaser uses or directs the use of the software. This applies to SaaS as well as cloud-based services.

The Department of Taxation and Finance decided that if a purchaser remotely accesses software over the internet, possession of the software transfers to the purchaser because he or she gains constructive possession and the right to use or control the software. As a result, selling a license to remotely access software is subject to tax and the sale is sourced to the jurisdiction in which the purchaser uses or directs the use of the software.

Electronically Downloaded Software Treatment: Taxable

New York imposes sales and use tax on prewritten computer software because the state considers it to be tangible personal property.

Prewritten software that is merely accessed by customers electronically, but not actually transferred to customers, is taxable as a sale of prewritten software. Sales of access to software are considered the transfer of possession. If the customer accesses the software within the state, the sale is sourced to New York, even if the software is stored on a server out-of-state.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In New York, SaaS and cloud computing are considered taxable because it involves a revenue stream from a license to use or direct the use of the software. Electronically downloaded software is also considered taxable because the state defines it as tangible personal property.

7. Taxability of SaaS in Ohio

Economic Nexus Provisions: Yes (cookie nexus)

As of August 1, 2019, companies with $100,000 in sales or 200 separate transactions establish economic nexus and are required to collect and remit sales tax, as long as they meet the threshold requirements in the current or preceding calendar year. As with Massachusetts, above, Ohio’s economic nexus law is a little different from many others because of the “cookie nexus” component.

SaaS and Cloud Computing Tax Rules: Taxable

Customers using a provider’s SaaS or cloud-based services to perform computations, run programs or store data is subject to sales and use tax in Ohio if the customer is using the service for business purposes. By statute, such services are included in the definition of a taxable sale.

If the consumer is using the service for personal purposes, then the service is not subject to tax, however charges are taxable where the service is received.

For services related to cloud computing, the service is generally considered to be received at the customer’s terminals. The nature of such services might produce instances in which the service provider cannot ascertain the location from which the service is accessed. In this case, the service is presumed to be used at the location of the customer’s billing address.

Electronically Downloaded Software Treatment: Taxable

Ohio imposes sales tax upon the sale of prewritten software regardless of whether it is delivered electronically or via load and leave.

SaaS and Cloud Computing vs. Electronically Downloaded Software

In regards to SaaS and cloud computing, Ohio specifies who the end user is; for business it’s taxable and for pleasure it’s not. However, all electronically downloaded software is subject to state taxes, regardless of who is purchasing it.

8. Taxability of SaaS in Pennsylvania

Economic Nexus Provisions: Yes

As of July 1, 2019, companies with $100,000 in sales establish economic nexus and are required to collect and remit sales tax, as long as they meet the threshold requirements in the preceding 12-months.

SaaS and Cloud Computing Tax Rules: Taxable

Cloud computing in the form of SaaS is subject to the state’s sales and use tax if the user is located in Pennsylvania.

The taxability of remote access to software in Pennsylvania depends on the location of the user. If the user is accessing the software from within the state, the transaction is subject to tax. If the user is accessing the software from an out-of-state location, the transaction is not subject to tax, even if the server resides in Pennsylvania.

The Department of Revenue determined that because computer software is tangible personal property, the charge for electronically accessing taxable software is taxable if the user is accessing the software from within Pennsylvania. In accessing taxable software, the user is exercising a license to use the software, as well as control or power over the software, at the user’s location.

Electronically Downloaded Software Treatment: Taxable

The retail sale or use of canned software (including updates) transferred electronically is subject to Pennsylvania’s sales and use tax laws.

Canned software is considered taxable tangible personal property because it is actually stored on a computer and takes up space on the hard drive. Software licenses are considered licenses to use canned software and constitute tangible personal property, regardless of the method of delivery.

SaaS and Cloud Computing vs. Electronically Downloaded Software

When it comes to SaaS and cloud computing, taxability is determined by the user’s location. Pennsylvania’s Department of Revenue considers a license to access the software a tangible, taxable item, just as it defines electronically downloaded software to be tangible and therefore subject to taxes.

9. Taxability of SaaS in South Carolina

Economic Nexus Provisions: Yes

As of November 1, 2018, companies with $100,000 in sales establish economic nexus. They are then required to collect and remit sales tax, as long as they meet the threshold requirements in the current or preceding calendar year.

SaaS and Cloud Computing Tax Rules: Taxable

This state taxes charges to access a cloud-based database, SaaS or online information service. This includes legal research services, credit reporting/research services, and charges to access an individual website (including application service providers).

Charges for computer software delivered by an application service provider are also subject to sales or use tax. The South Carolina Department of Revenue considers an application service provider to be sufficiently similar to “database access transmissions,” which were ruled to be subject to sales and use tax.

“Database access transmissions” are defined as the transmission of computer database information and programs by and through a modem and telephone lines, whether automatically transmitted or transmitted as a result of a subscriber accessing a computer, for which charges may be based on the amount of time the transmission is utilized.

Additionally, software subscriptions services are considered tangible property and are subject to sales and use taxes.

Electronically Downloaded Software Treatment: Nontaxable

Prewritten software delivered electronically is not subject to tax.

SaaS and Cloud Computing vs. Electronically Downloaded Software

While electronically delivered software isn’t taxable in South Carolina, SaaS and cloud computing are considered taxable as they’re similar enough to “database access transmissions.”

Contact Us to Learn More About the Taxability of SaaS

Are you still wondering how multi-state tax issues may affect your company, especially in regards to SaaS, cloud computing and electronically downloaded software? Contact us today! We’re happy to answer your questions about these areas, as well as other ways multi-state tax law may affect your business.

For additional information and a recent overview of SaaS taxability, please click here.

Miles Consulting Group, Inc. is a professional service firm in San Jose, California specializing in multi-state tax solutions. Our firm addresses state and local tax issues for our clients, including general state tax consulting, nexus reviews, tax credit and tax incentive maximization, income tax and sales/use tax planning and other special projects. To learn more, contact us today at www.MilesConsultingGroup.com.